What is Google Pay?

So you have come so far to know about the Google Pay transfer limit, Google Pay is a digital and easiest method to receive or send money home to our relatives, family, children, or neighborhood. Google pay is an application created by Google and tap-to-pay purchases on cell phones, empowering clients to make payments with Android mobile phones, tablets, or watches. Clients in the United States and India can likewise utilize an iOS gadget, though with restricted functionality. Moreover, google pay also helps and supports passes, for example, coupons, understudy ID cards, occasion tickets, film tickets, public transportation tickets, and many more.

Google pay helps you send or get cash with zero charges, directly from your account to nearly anybody. You can send or bring some money regardless of whether your contact isn’t on Google Play. You can have lunch with your friend, pay your landlord or send some money to your mother. You can win scratch cards and awards worth up to ₹1,00,000*. Your prizes will go directly to your bank account in case you win.

What is Google Pay Transfer Limit?

You can not transfer as much money as you want from google play. There is always a limit to everything. In the same way, there is also a google pay transfer limit. So if you are using or going to use the google play app, you need to be aware of google pay transfer limits. Let us know about google pay daily transfer limits.

Google Pay Daily transfer Limits

If you are also among those using the google pay services, you must be aware of google pay transfer limits. The daily transfer limit of google pay is:

▪️ The daily transfer limit of google pay is ₹1 lakh. This means you can not send or receive more than ₹1 lakh in a day through the google play app.

▪️ To protect its customers’ security, google pay has limited the number of transactions you can make in a day. You can not use google pay more than ten times to transfer money.

▪️ To send or receive more amount of money or more than ten times, you have to wait till the next day.

Bank Limits

If your daily transactions are under the limits of google pay and you are still not able to make any transaction, you should try a different bank account. Your bank may have its cut-off points on the amount you can send or get. Contact your bank for more data. This is because google pay has to follow the transaction limit set by your bank.

To secure against any fraud, a few transactions may get flagged for additional consideration. In case you’re experiencing difficulty making an exchange, and you don’t think you arrived at a transfer limit point, contact Google Play customer support for more assistance.

Note: If you try to send or get under ₹1, you’ll get an error message, and you can not transfer the money.

Credit Card Services

Google Pay also gives an option to use credit card services. You understand and accept that Credit Card Institution will regulate the credit card. Google isn’t involved with such arrangements and has no job. It doesn’t make any portrayals, guarantees, or assurances of endorsement or destruction of the Card Application, which will be managed only by the Credit card institution giving the Credit Card. Google’s job opposite such Credit Cards will be restricted to giving innovation administrations identified with Credit Cards offered by Credit Institutions and teaming up with Credit Institutions to provide types of assistance and suggests identified with Credit Cards that might be remarkably accessible to Google Pay clients (e.g., Axis Bank ACE Card, which is given by Axis Bank and showcased in a joint effort with Google).

Loan Facility Services

Google Pay gives an innovation stage to show Loan Facility offers from Credit Institutions to You. You understand and accept that such Loan Facility’s particulars will be administered by the advance arrangements executed among you and the Credit Institution. You realize that Google will not interfere in these loan services and agreements. The role of google shall be limited to these as these loan facility services will be given to you by the credit institution.

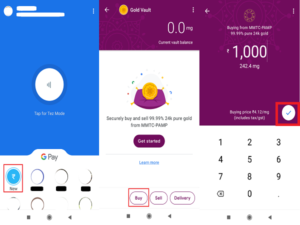

Google Pay Transfer limit in Gold Services

Google Pay gives an innovation stage to MMTC – PAMP (“MMTC”) to offer Gold available to be purchased, conveyance and repurchase, and other related administrations by MMTC to the Customers. You concur and recognize that the terms and conditions accessible at MMTC Terms oversee your GAP. Google will have no risk to You corresponding to Your GAP.

Limitations on using the Google Pay Service

Google pay or Payment Participants have their cut-off points concerning the utilization of Google Pay. Google pay claims all authority to change, suspend or end any part of Google Pay whenever, including long stretches of activity or accessibility of Google Pay Services or any Google Pay Service highlight, without notice and risk. Google pay likewise to maintain all authority as far as possible on specific highlights or limit admittance to parts or the entire help without notice and risk. Google pay may object to handle any Payment Transaction without earlier notification to Sender or Recipient.

Transaction Limits

Every Transaction is dependent upon the least and most extreme Transaction restrictions. Google might set that a User, the Payment Participants, or recommended under Applicable Law’s arrangements. What’s more, Google and the Payment Participants may likewise dismiss/suspend Transactions (in entire or to a limited extent) on your Google Account on Google Pay dependent on their separate arrangements and appraisal.

Transaction Records

Whenever you make any transaction on google pay, your transaction history will be saved by google pay. You are answerable for looking into your Transaction action to decide whether there are any errors or unapproved Transactions and for cautioning Google of such occasion, as per the Combined Google Pay Terms.

Want to Read more? and Know about Google?

Here’s How To Change Google Pay UPI PIN

10 Hidden Google Apps You’ve Probably Never Heard Of

Best VR Content Apps On Google Play Store